The payment card industry (PCI) denotes the debit, credit, prepaid, e-purse/e-wallet, ATM, and POS cards and associated businesses.

Card Schemes:

The card schemes come in two main varieties - a three-party scheme (or closed scheme) or a four-party scheme (or open scheme).

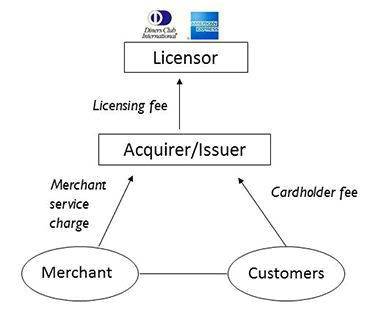

Three-party scheme

A three-party scheme consists of three main parties

A three-party scheme consists of three main parties

In this model, the issuer (having the relationship with the cardholder) and the acquirer (having the relationship with the Merchant) is the same entity. This means that there is no need for any charges between the issuer and the acquirer.

Since it is a franchise setup, there is only one franchisee in each market, which is the incentive in this model. There is no competition within the brand; rather you compete with other brands.

Examples of this setup are Diners Club, Discovery Card, American Express and other closed loop system like Restaurant Checks.

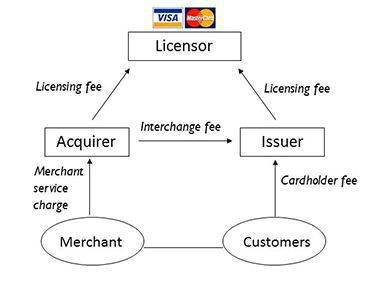

Four-party scheme

In a four-party scheme, the issuer and acquirer are different entities, and this scheme is open for other members of the scheme to join in the competition.

This signifies card schemes such as VISA and Mastercard. There is no limitations as to who may join the scheme, as long as the requirements of the scheme are met.